1031 Exchange Services

Wolterman Law Office is a national provider of tax-deferred 1031 exchange services. Our attorneys have over 20 years of combined experience and offer total change management, knowing that a 1031 exchange is not just a single isolated transaction, but also part of a comprehensive business strategy.

Successful 1031 exchanges are contingent upon adherence to deadlines and strict provisions, requiring substantial real estate and tax law experience. Our attorneys have the knowledge to handle even the most complex transactions. Together, with our team, we provide:

- An analyzation of your current tax situation.

- A comprehensive tax and business strategy to reduce overall tax and financial costs and reach your business goals.

- Assistance with restructuring your real estate assets, your entities, and partnerships to maximize your tax benefits.

We can assess your situation and recommend options to help you decide whether a 1031 exchange will be beneficial. Our Ohio 1031 exchange services lawyers provide reliable service, a timeline, and guidance. Most importantly, we prioritize personal attention, and our clients work directly with exchange specialists, attorneys, and company owners.

What Are 1031 Exchange Benefits?

Some important benefits of a 1031 exchange:

- Tax advantages: Property that is transferred or sold for gain is subject to taxation. Through a properly executed exchange facilitated by our firm, investors can hold onto their equity without being subject to heavy capital gains taxes, ordinary income tax, or depreciation recapture. If you exchange investment property for like-kind property, there is no immediate tax liability. This makes an exchange an appealing option for investors eager to retain the property’s equity for re-investment.

- Investment diversity: 1031 exchanges also allow investors the ability to regionally diversify their investments. Investors who accumulate numerous diversified investment properties over time often find managing a group of properties cumbersome. Through a 1031 exchange facilitated by our attorneys, a group of properties can be exchanged for a single property, simplifying property management.

- Inheritance: A common challenge among families who inherit a substantial piece of real estate is agreeing on what to do with the property in the long-term. Our attorneys provide families with the opportunity to acquire several properties in exchange for one large property. This helps each family member realize their individual investment goals.

Other benefits of doing a 1031 exchange include:

- When selling an investment property and replacing it with another one, federal and state capital gain taxes are deferred.

- Recaptured depreciation taxes are also deferred.

- It is similar to having an interest free loan over an indefinite period.

- Additional capital can be used to generate more cash flow, diversify your portfolio, and boost your depreciation for tax strategies.

1031 Exchange Timelines to Know

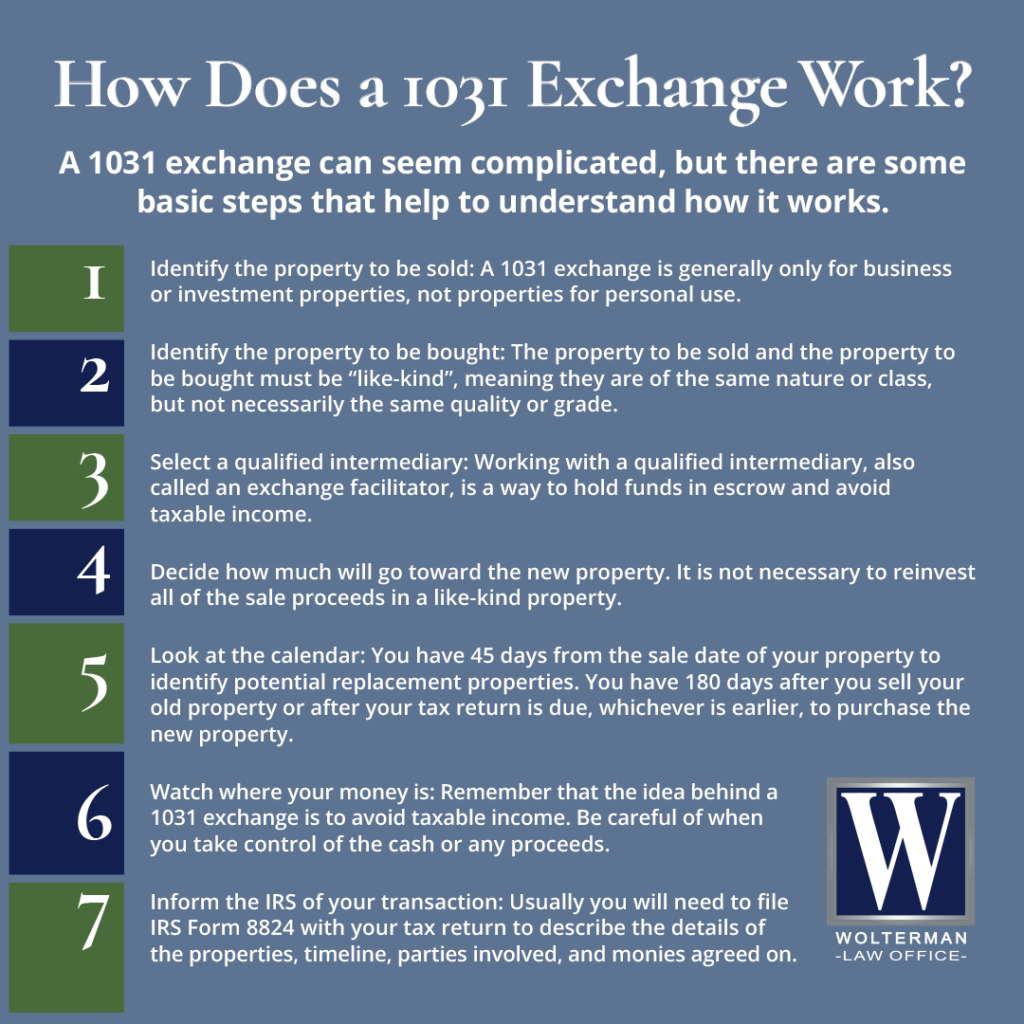

When a 1031 exchange is conducted, there are two timelines that run concurrently:

- Identification period: You have 45 days from the closing date on your relinquished property to identify one or more replacement properties. The replacement property does not have to be under contract on the 45th day. The qualified intermediary (QI) facilitating the 1031 exchange provides a form used to finalize the identification period. If the form is not received by midnight on the 45th day of the identification period, the exchange automatically terminates. The funds from the sale of the relinquished property are forwarded, meaning capital gains tax will be due and payable that same tax year.

- Exchange period: Escrow must be closed within 180 days from the closing date of the sale of the relinquished property. When a 1031 exchange begins in one tax year but may not be finished until after the next tax year starts, an extension for the federal income tax return must be filed to receive the full 180 days. If an extension is not filed, the exchange will end on the original tax return due date.

1031 Exchange After Closing

It is common for a QI to get questions from taxpayers who have closed the sale of their relinquished property, obtained the sale proceeds, and then discovered they should have differed substantial taxes in a 1031 exchange. In many instances, it is difficult to revive the exchange. However, there are cases when a taxpayer can rescind the transaction if the taxpayer receives the property back from the buyer and refunds the full purchase price on or before the end of the tax reporting period. In those cases, the IRS will treat the sale as if it never happened.

1031 Exchange Funds and Closing Costs

Pre-closing costs include all maintenance and fix costs that are incurred to prepare the property for sale. Costs that are incurred outside of escrow or the closing process should not be paid using 1031 exchange funds unless the seller is willing to pay tax on the amount spent. Sellers should not be reimbursed for such costs in escrow without being taxed, so it is best to pay for any pre-closing costs out of pocket.

What Are Common 1031 Exchange Structures?

- Simultaneous exchange: A simultaneous exchange is a same day buy and sell. It can either be an actual trade of properties, or the investor can sell the relinquished property and buy the replacement property on the same day. Simultaneous exchanges still require either a QI or another third-party to keep the taxpayer from directly touching the exchange of funds. The replacement property must be valued the same or higher than the relinquished property or the taxpayer will have a tax event.

- Delayed exchange: The delayed exchange is the most common usage of 1031. It involves the investor selling the original property, also called the “relinquished property,” and directing the proceeds to the QI. Identifying potential replacement properties must occur within 45 days of the sale of the relinquished property, and the replacement purchase be completed within 180 days, including the identification period.

- Reverse exchange: When investors identify a desirable property before deciding to sell a property, they may initiate a reverse exchange. Because they cannot own both the replacement property and the relinquished property at the same time, the investor has a QI, referred to in these cases as an exchange accommodation titleholder temporarily hold title to the new property, while finding a buyer for the property designated for sale.

- Improvement Exchange: The construction or built-to-suit exchange is less common than delayed or reverse exchanges. It is used when an investor needs to improve the new property before taking possession. In these cases, the investor sells the relinquished property, identifies the replacement, and completes the required improvements while the QI holds it. The QI can pay for the improvements using proceeds from the sale of the relinquished property.

Successfully conducting a 1031 exchange takes thorough planning. Unlike most QI companies, we are qualified to give legal advice regarding the 1031 exchange process and provide recession agreements. We assist real estate clients with structuring complex tax-deferred 1031 exchanges under all types of investment real estate, including condominium and cooperative units or apartments, multiuse and office buildings, as well as industrial properties.

Ohio 1031 Exchange Services Lawyers at the Wolterman Law Office Will Provide Comprehensive Legal Advice During Your 1031 Tax Exchange

Our Ohio 1031 exchange services lawyers at the Wolterman Law Office facilitate 1031 exchanges nationally, using tax strategy, exchange management, tax compliance, tax opinions, and consulting. We provide services that include all like-kind exchanges, including delayed, improvement, reverse, and park arrangements. Call us at 513-488-1135 or contact us online to schedule a free consultation. Located in Loveland, Ohio, we proudly represent clients in Hamilton County, Fairfield, Norwood, and Forest Park.